Vonto - Hunting for product/market fit

Problem statement: Vonto was failing to find product/market fit. With poor numbers of active users, engagement or retention.

Initial steps of design process

The first step in this process was to conduct a range of interviews with existing and potential new target customers. I worked with the rest of the design and product team to interview 15 small business owners to discuss with them their pain points around managing their business, with a particular focus on business data and metrics.

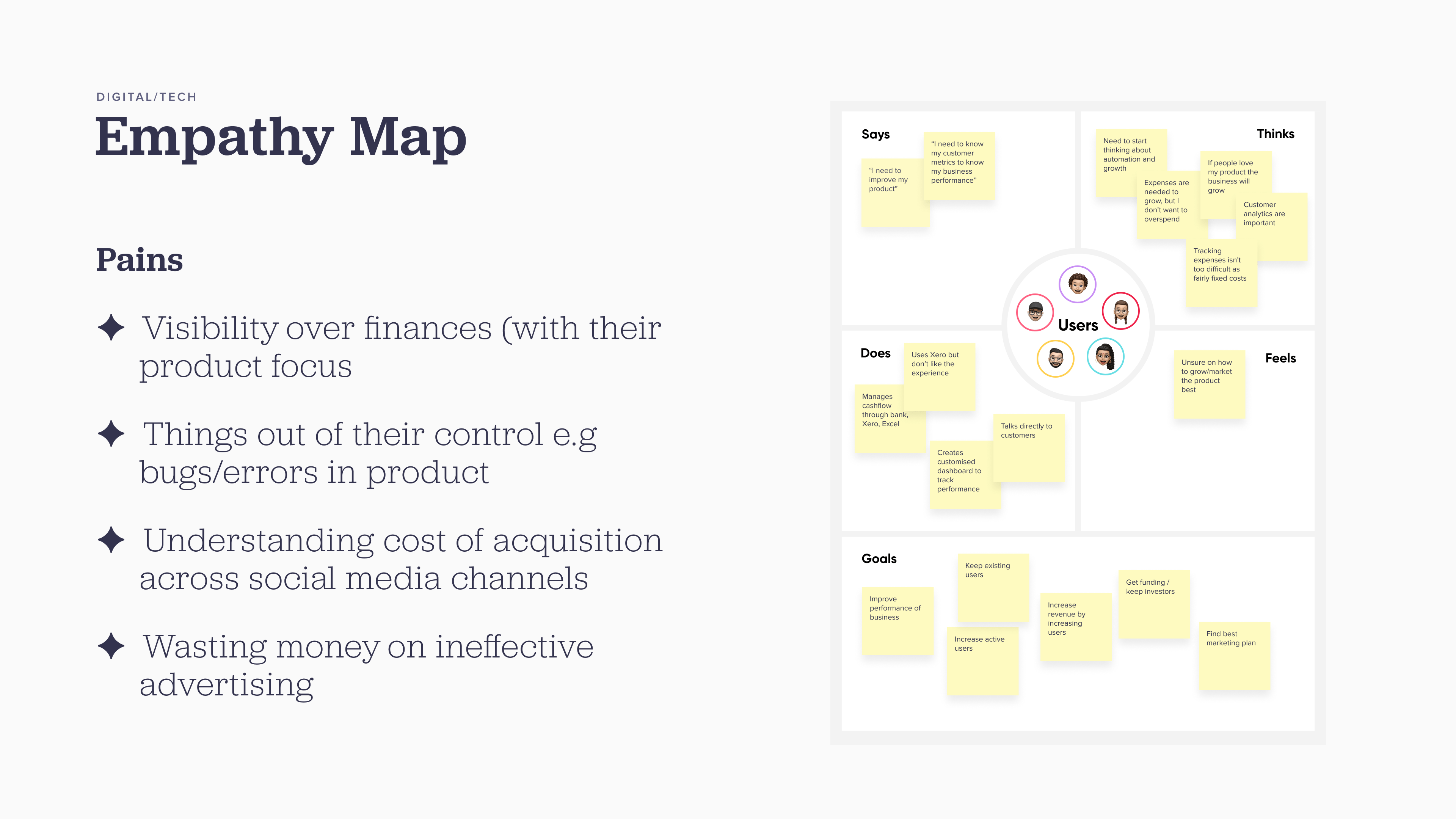

After talking to customers from retail, hospitality and tech we went through a process of theming and creating empathy maps for each of our target markets. We found many commonalities in goals and pains across tech founders (as well as other businesses) e.g. many founders feeling like finances were a chore or a difficulty, instead wanting to focus on building their product or business. However we also found out how different the contexts of these industries are, of particular relevance to Vonto: the types of business tools, key metrics and business models were very different between tech, retail and hospitality.

Aside from simply helping us look for new potential markets to pivot towards, these interviews also provided us a range of insights around problems, goals and contexts that we could take forward into the upcoming solution design phase.

After this initial research, we made the decision to explore the tech industry as a new direction. Our findings indicated frustration with finances (it being seen as boring, distracting admin work), difficulty staying aware of all their different metrics, and importantly: a high usage of digital tools that Vonto could integrate with.

Empathy map of tech persona following initial ~15 interviews.

To test our assumptions around the key problems to try to solve we conducted a further 8 interviews/tests with people in our target demographic (founders at small tech startups). These consisted of a 30min chat to start with in order to understand if these were really problems founders faced, and to gauge how much of an issue these caused.

From there we moved on to a problem/solution test format, showing them our prototyped ideas and discussing with them if they saw value in the concepts, if they could see it solving the problems they face, and how it would compare to other tools and substitute to do this.

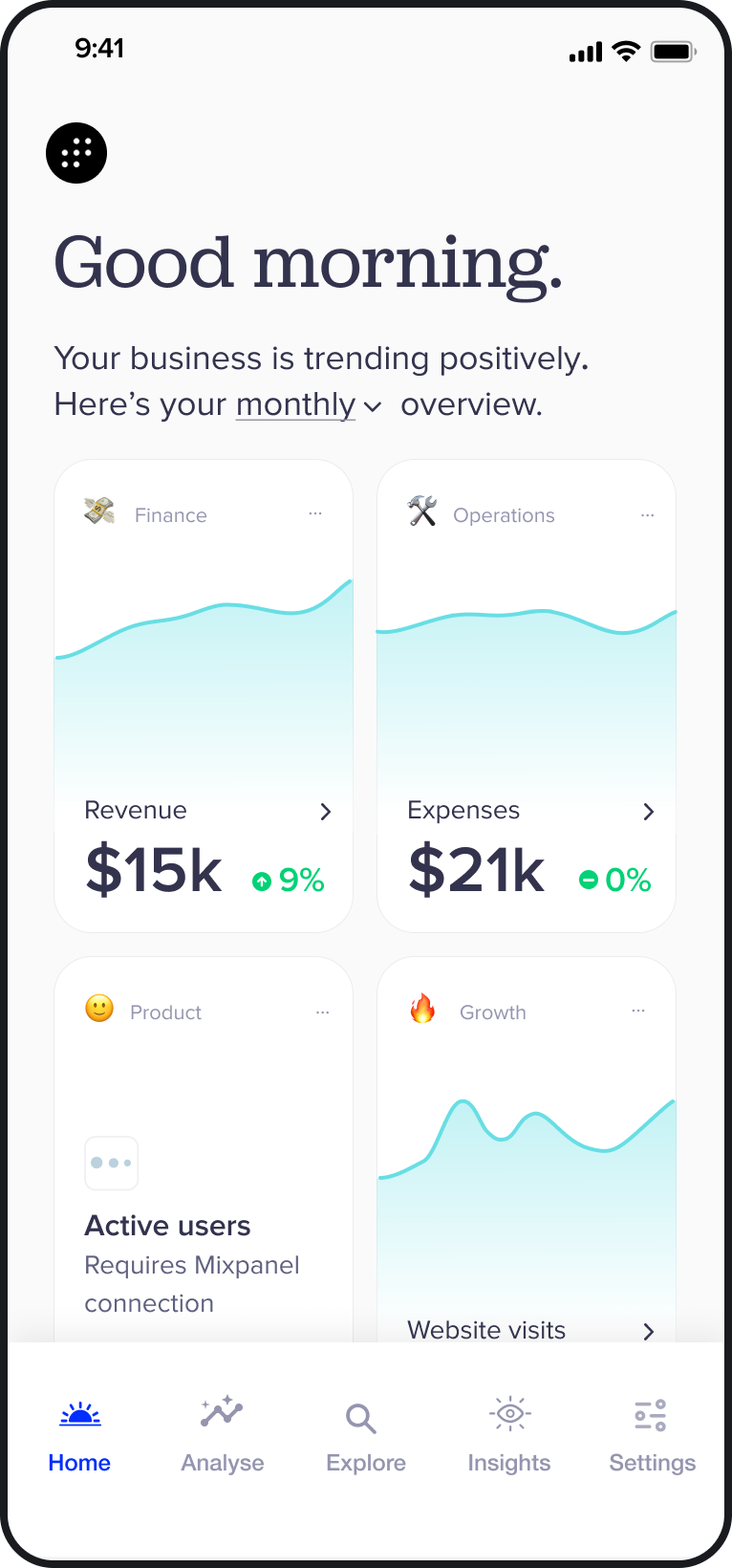

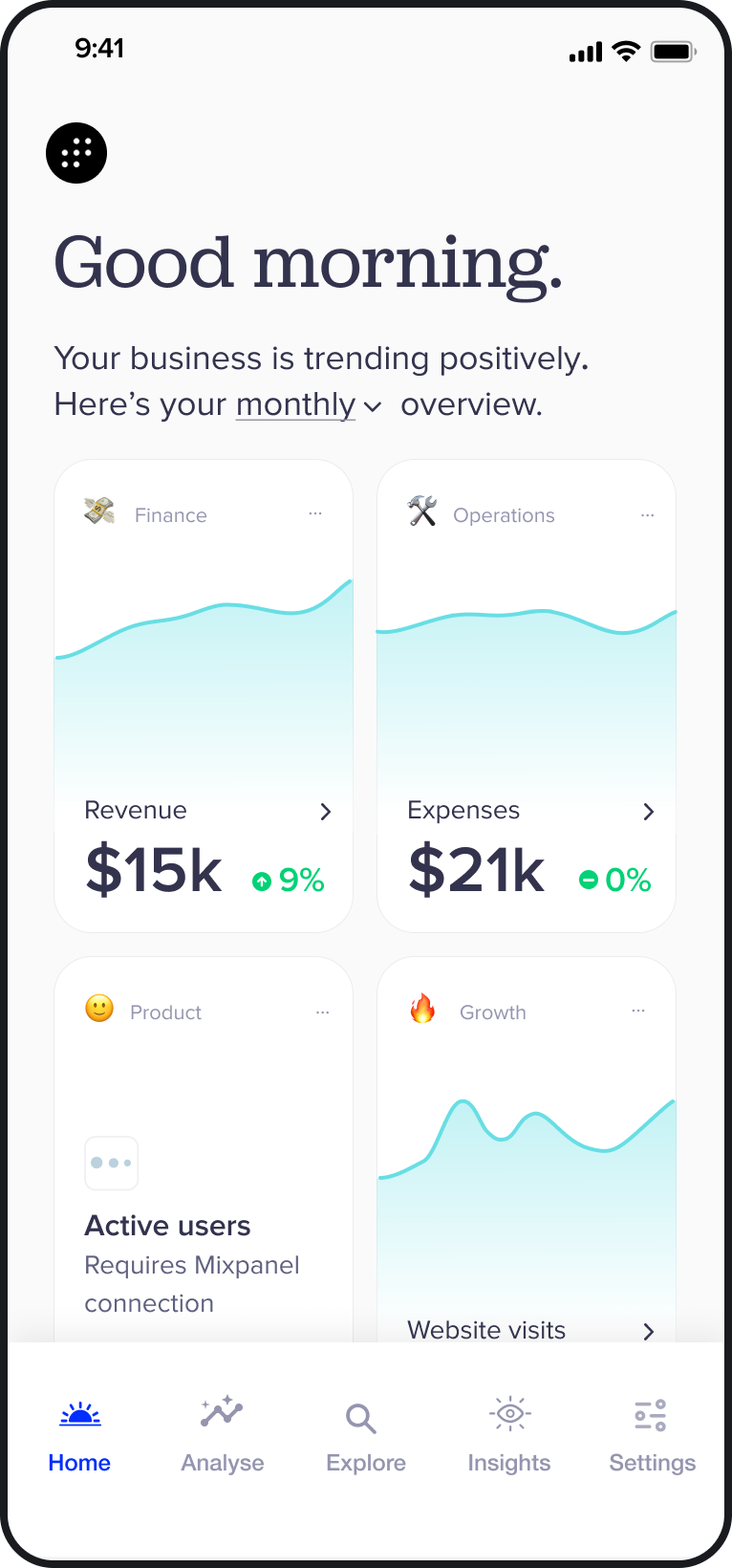

This prototype offered a simple overview and the ability to go deeper into key metrics, a typical dashboard approach. We quickly found that this was of low value, with founders happy to get these metrics from existing dashboards in their respective tools e.g. Xero, Stripe, Analytics.

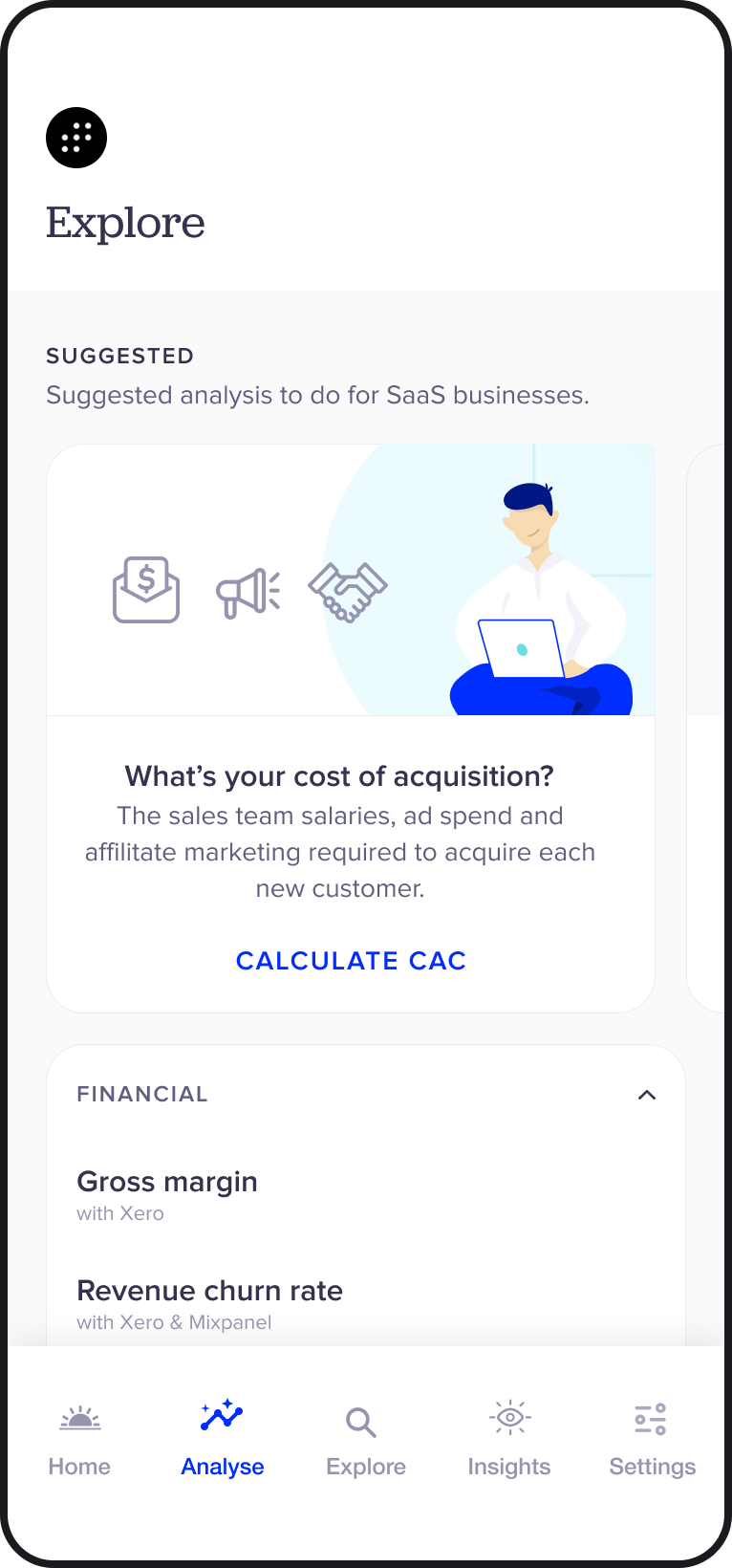

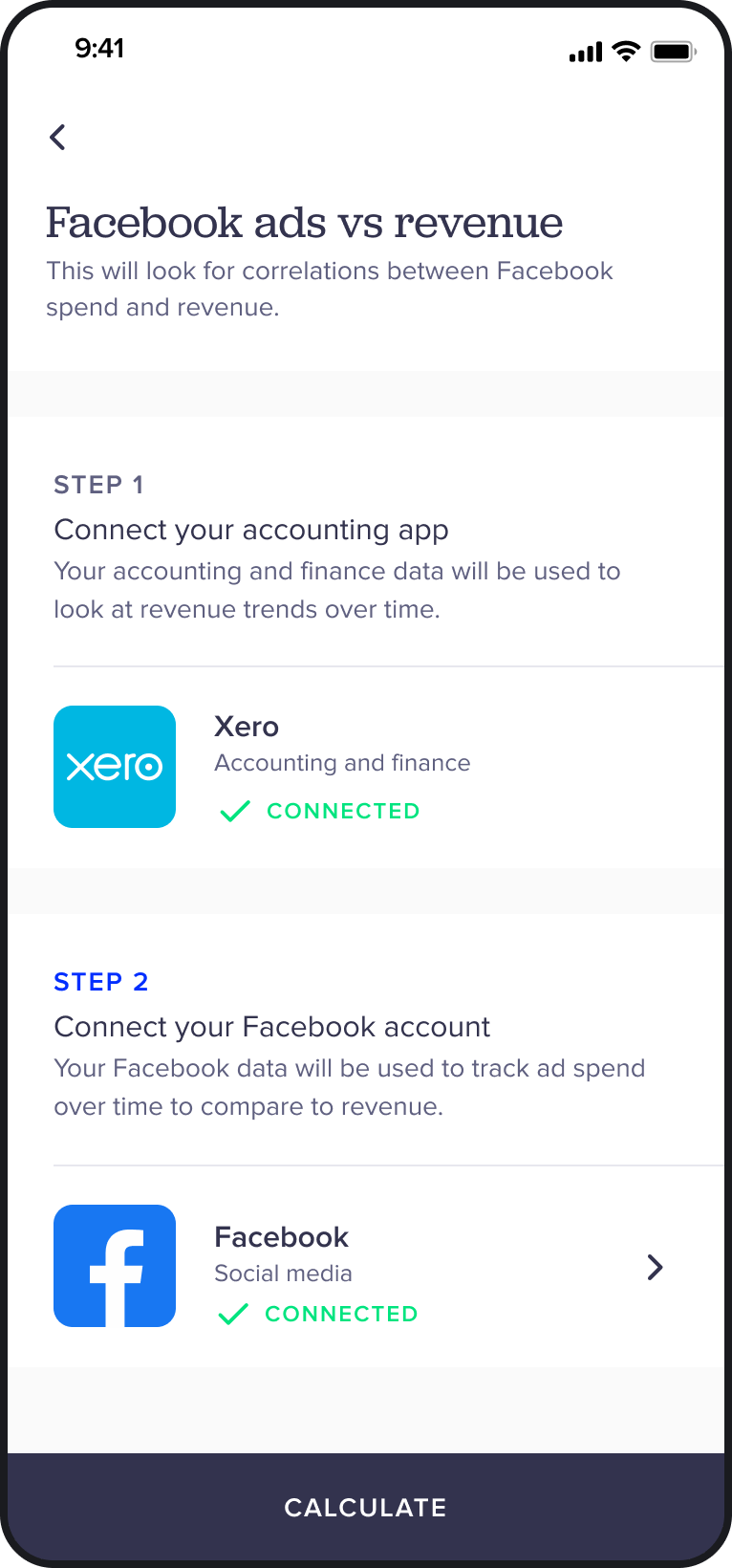

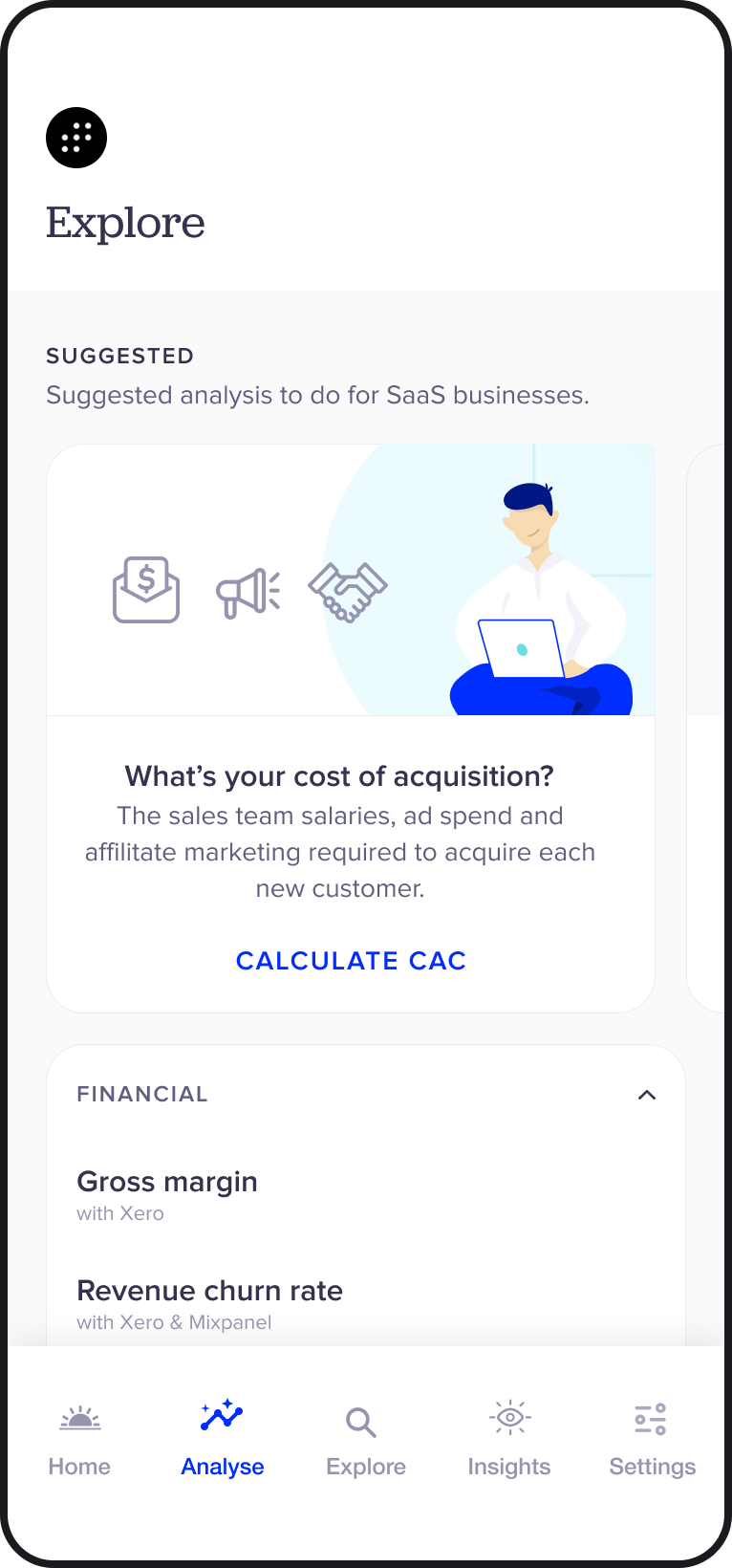

Here the app walks users through the process of combining data from multiple sources to create a cost of acquisition metric, giving them guidance and an understanding of metrics that usually have to be calculated manually.

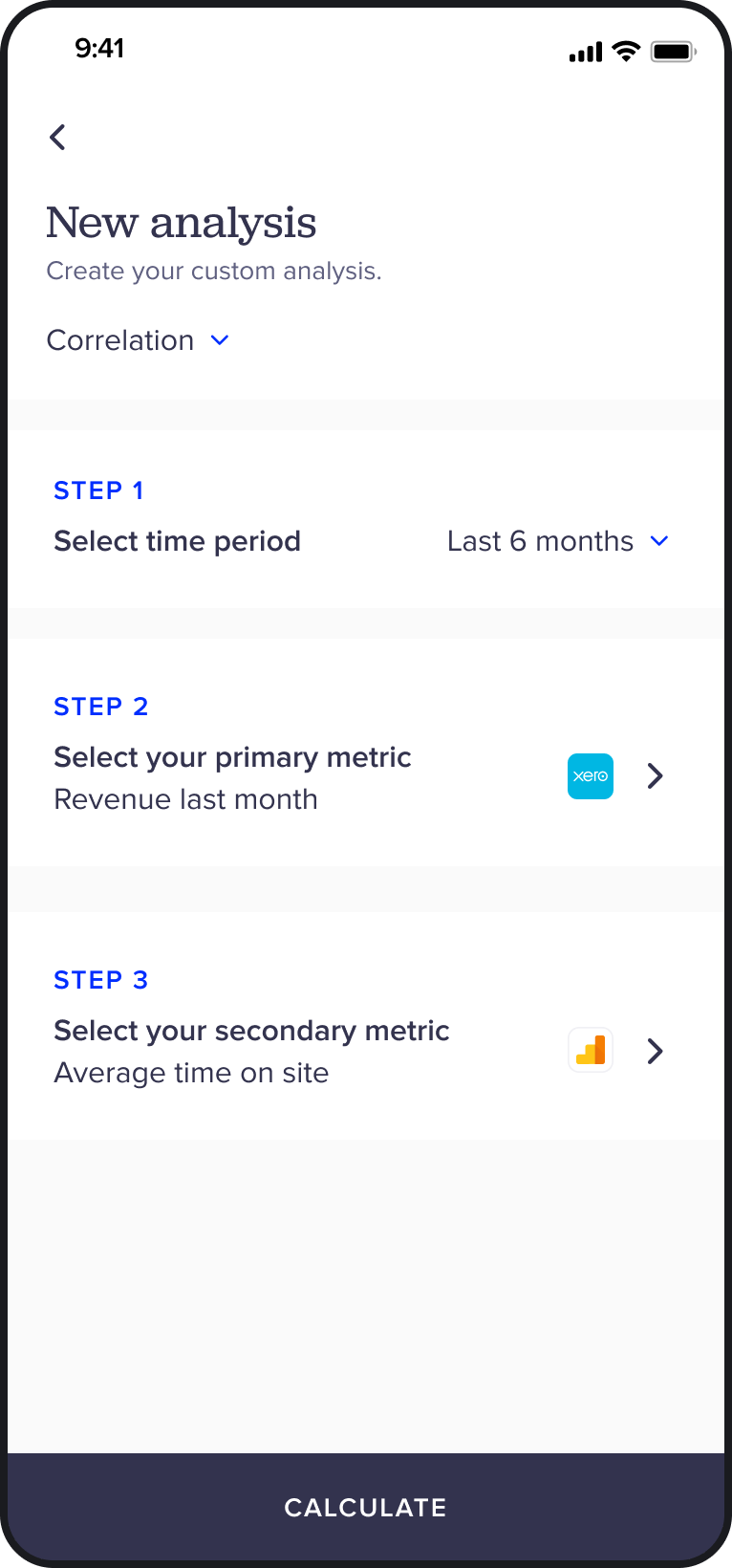

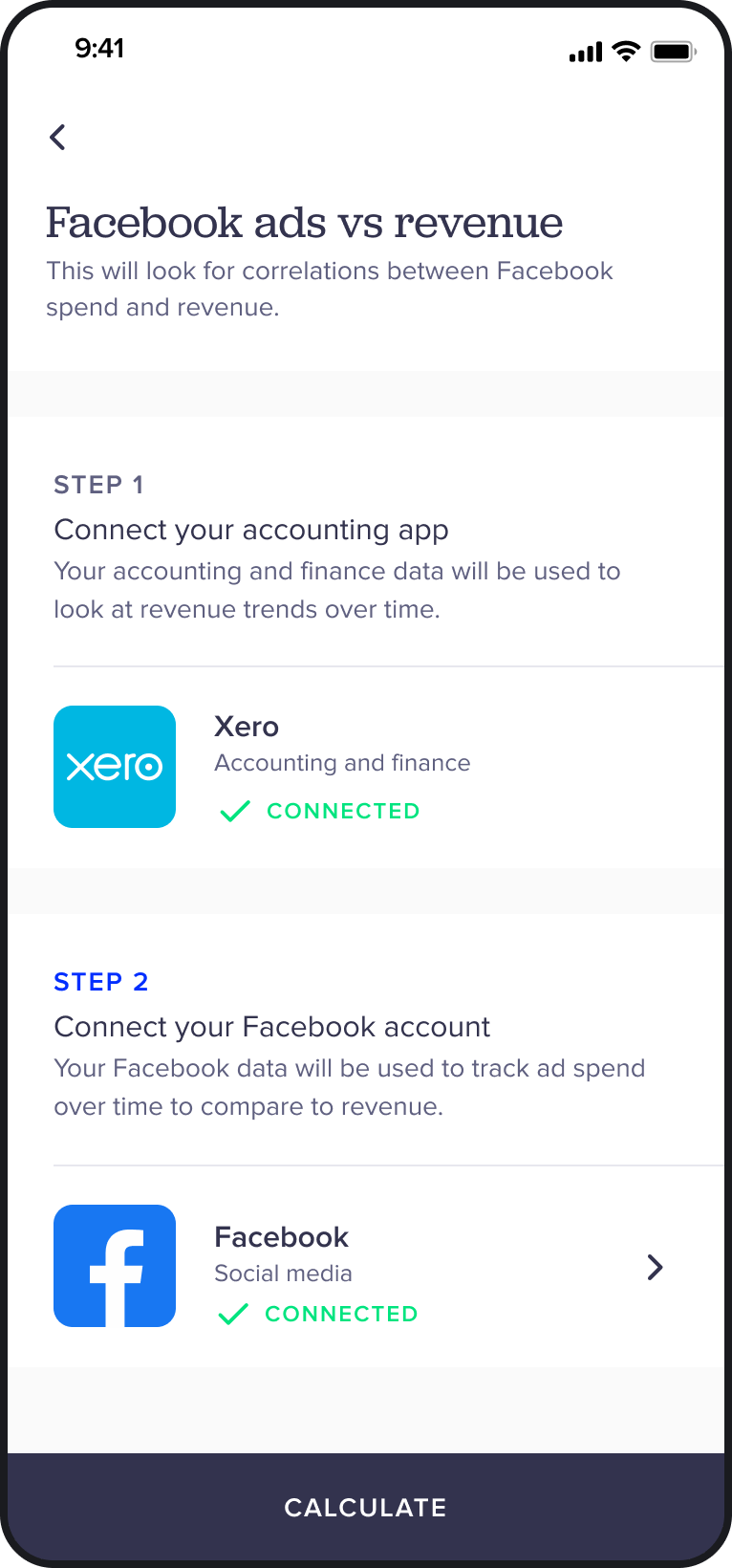

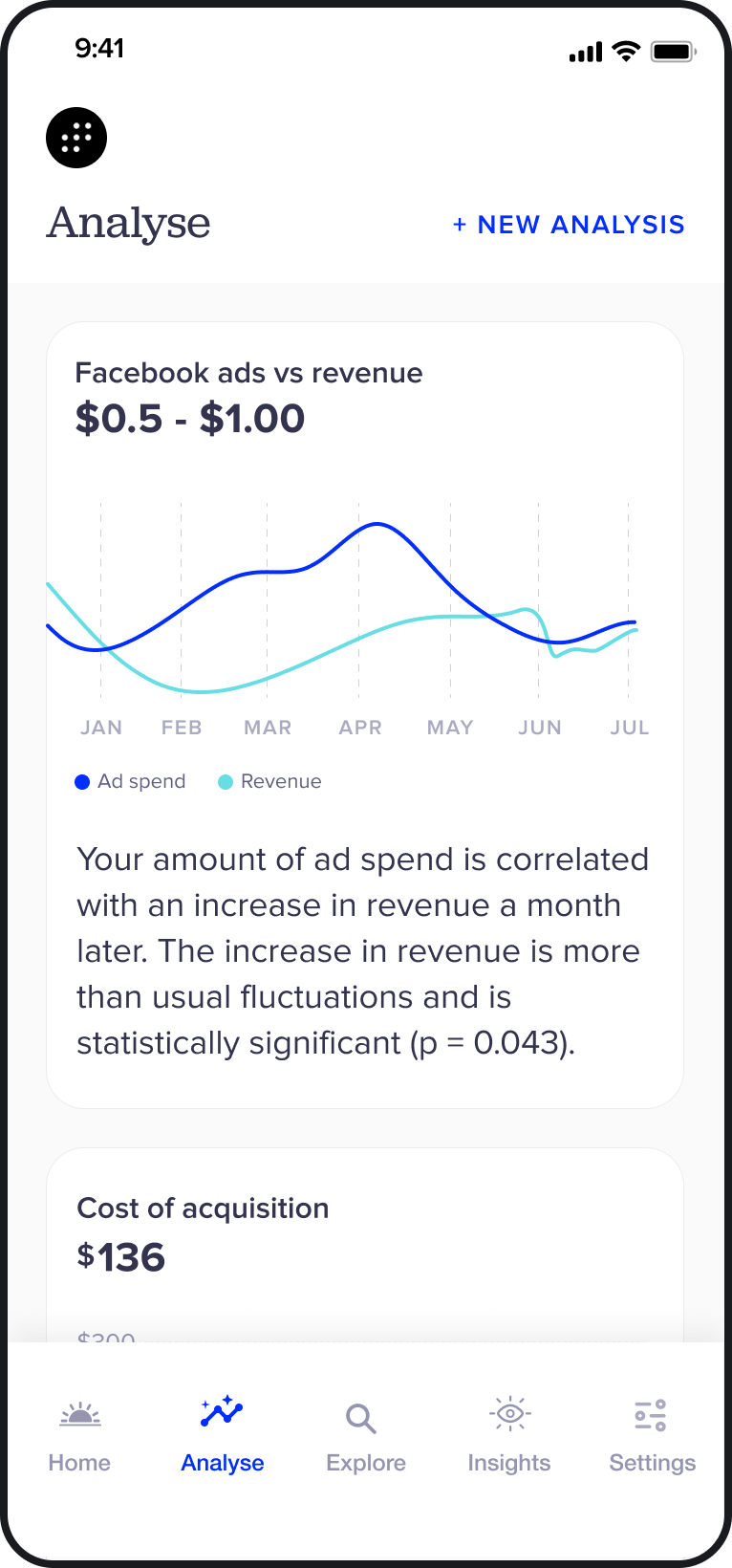

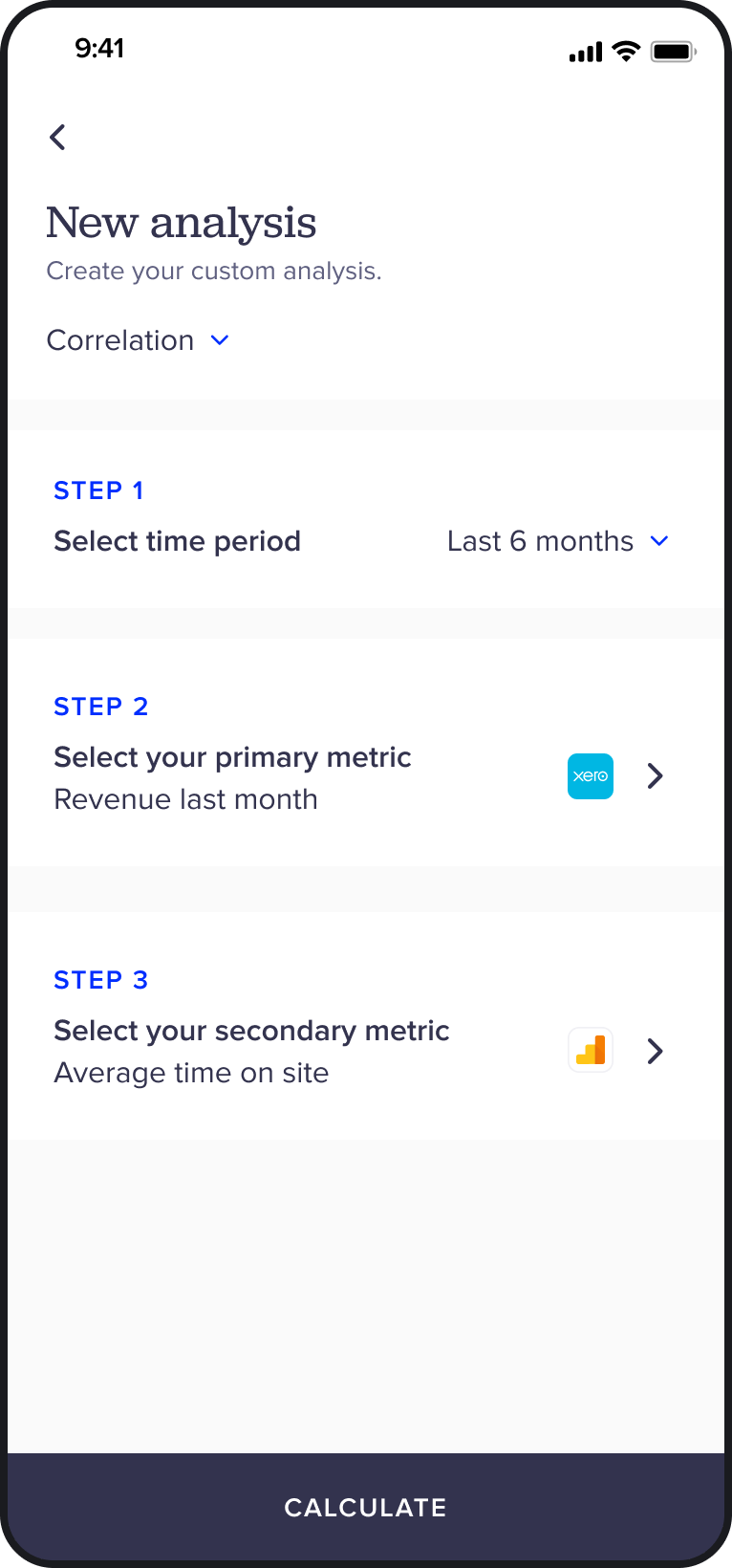

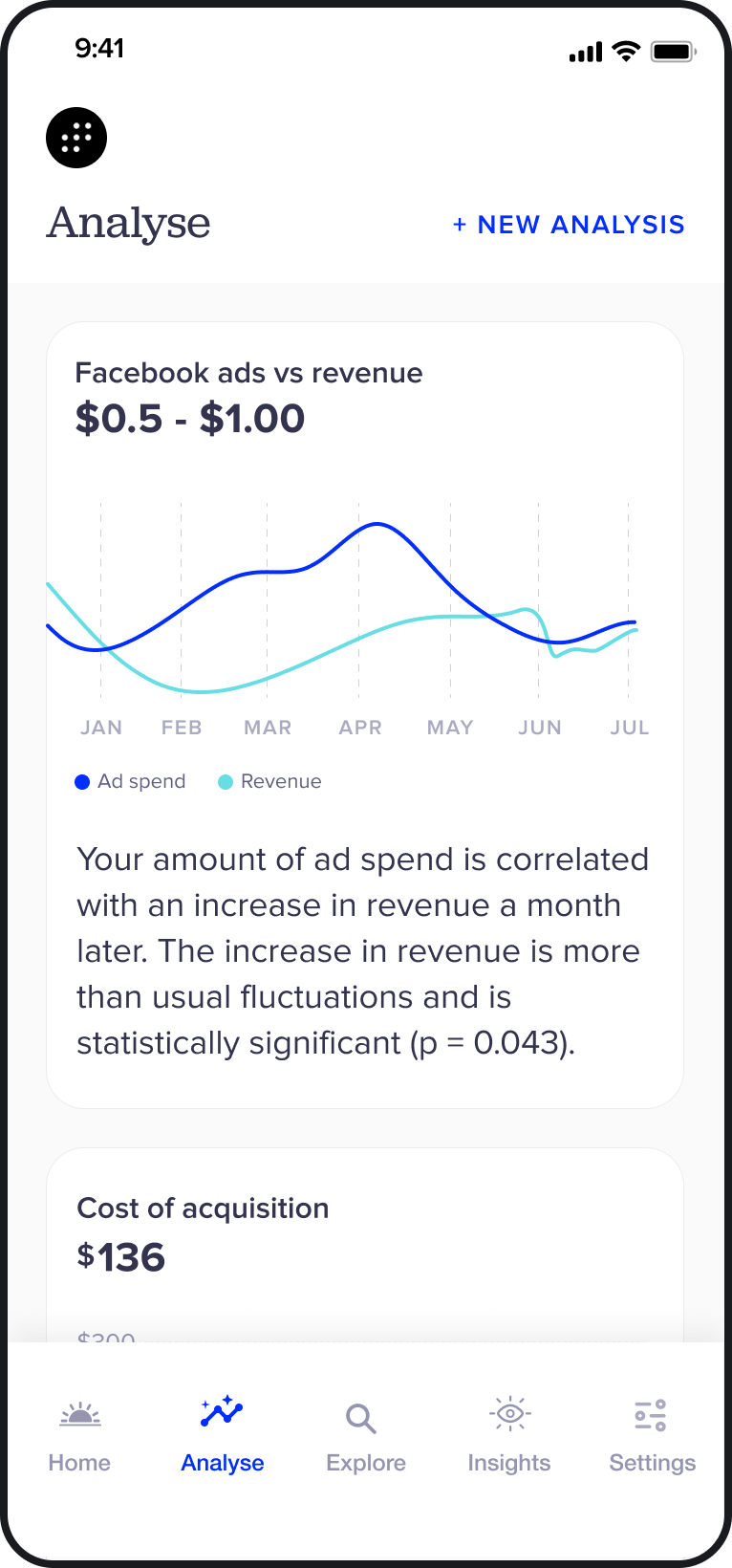

This flow offered a potential solution to understanding the impact of business decisions by allowing users to look at correlations in their data for a high-level understanding of what impact what. In this example, does ad spend correlate with any increase in revenue?

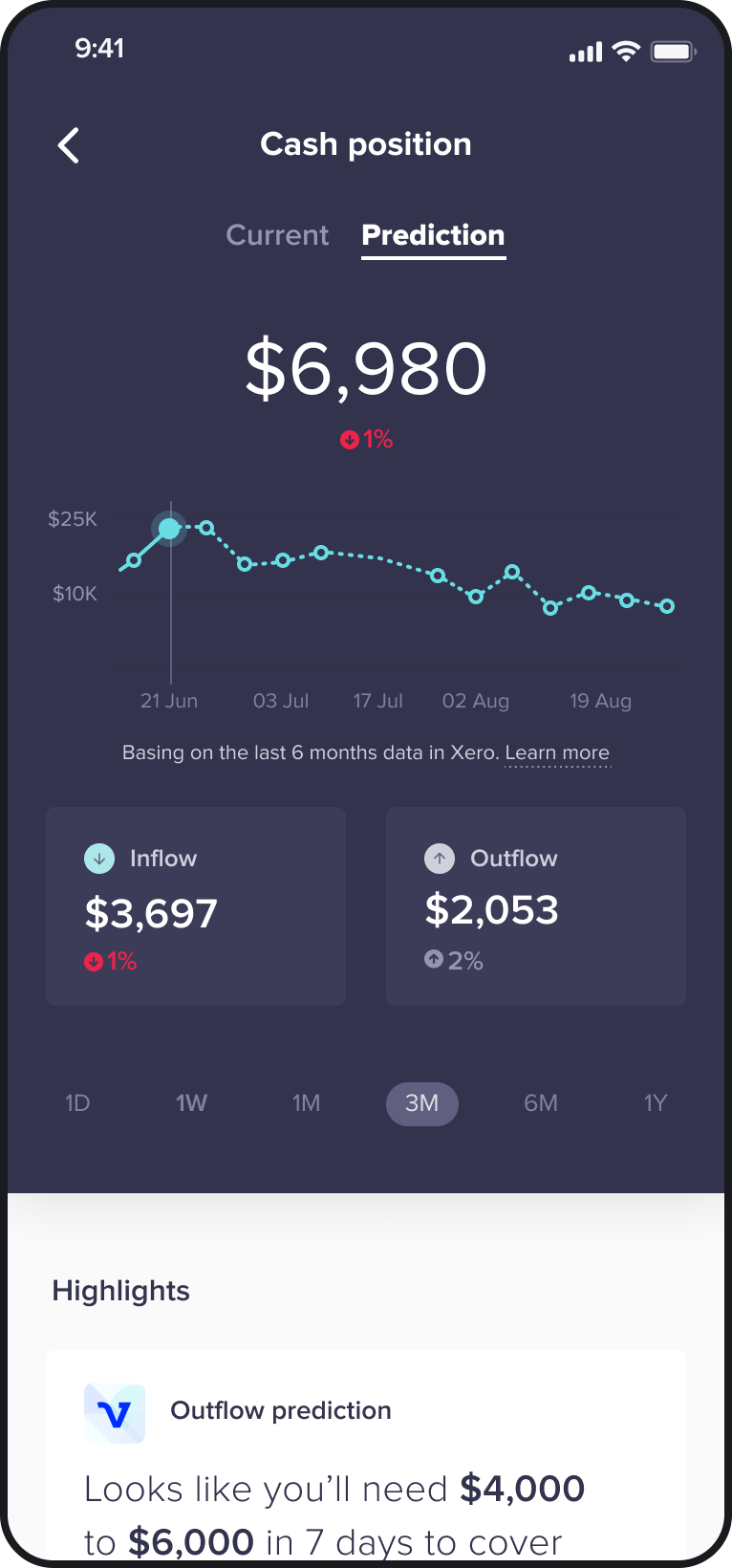

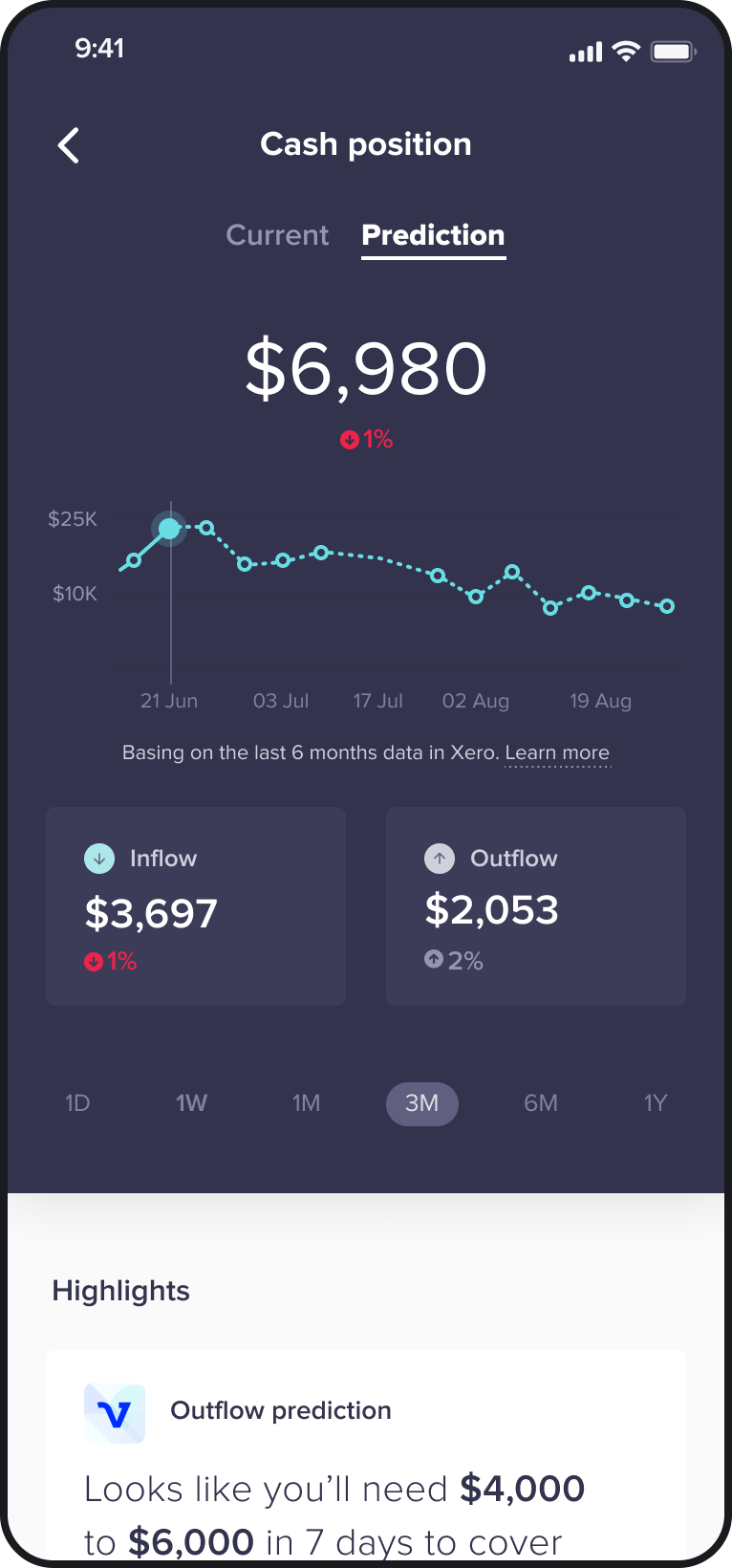

👉 We also tested solutions around sharing metrics and data, as well as projections into the future. However, I haven't included the screens here as that work was done by my talented colleagues.

We got some very helpful information from this round of testing, however, the clearest feedback we got was feedback that enabled us to eliminate ideas. An example of this was the strong feedback that there was no value in repeating information from existing platforms even if we were aggregating from multiple platforms.

Other insights lined up with our assumptions around problems and features, like founders struggling to pinpoint what is working and having to do manual data manipulation in excel to get particular metrics. Features that offered to solve these problems (calculating metrics, correlating data, and suggestions on what to calculate or correlate) were the most well-received, however, they weren't runaway winners.

We also picked up some very practical insights, unique to our new target market of tech, such as the need for a Stripe integration, and that a desktop-first approach would be best. This helped inform our second round of design and testing.

Theming the results of our round of interviews based on our assumptions from previous research and knowledge.

💡 Additional example insights:

If nothing else, this project made me very familiar with remote testing

With the second round of testing, we had hoped to refine some of our promising solutions and offer new secondary offerings to create a winning set of features. Part of this testing was therefore to rank and rate our key offerings so we could gauge interest. Through the testing, discussions and rankings it became obvious that while there were aspects that interested founders more than others, none of these options was enough to really excite them and give us the confidence to move forward with a particular direction.

The biggest realisation of this phase was arriving at the conclusion that we were going to be able to take the testing of a value prop with example content. While we were testing a range of features that weren't strictly content-dependent it was obvious that Vonto would need to prove its ability to generate valuable, personalised insights to truly gauge interest and value for users. A typical response being: "This would be really useful, if it really can provide what it's promising, but this example isn't really relevant for me".

Features like manually being able to create correlations, calculations and other data querying tools were interesting and some participants had previously looked for or tried competitor tools in order to better understand their data. However, without being able to demonstrate truly impactful insights based on their data the potential value of Vonto was much less obvious.

From this round of interviews & testing, we also clarified some of our thinking around the key value prop of Vonto. From previous research, Vonto had identified four key value props:

After these two rounds of testing we had seen strong evidence that, at least for this target market, the primary value proposition was to form novel insights by combining data sources.

This informed our design work but more importantly formed our underlying recommendations going forward. The highest priority recommendation being:

This was important both to prove they were possible to create with the data available and that they were valuable and actionable to business owners. This was luckily already happening to some degree, however with limited access to real data from tech startups and with less familiarity with key tech tools like Stripe.

After this research and testing my role began to be scaled back, beginning to hand over to Vonto's new internal designers. This meant that my end deliverables ended up being recommendations and a smooth handover of designs - rather than a final set of screens or product strategy.

I was disappointed to finish the project without a clear direction formed. I felt that the direction we had arrived at was still unclear on priorities and with several questions and risks that we hadn't effectively addressed yet, such as if we could actually deliver insights of as high value as we were hoping for.

Starting with finding and validating a problem before moving onto a solution is a standard part of the design process, however, it's still common to have projects that end up being a solution looking for a problem. This project really made this obvious to me. Even though we were given an open brief, and were able to go back to a problem definition phase, we were still limited in our ability to validate or invalidate some of these problems due to the momentum behind the existing app. i.e. we didn't feel able to discard the core problems that Vonto looked to solve, even if we felt these weren't viewed as large issues by users.

Ensuring that the problem space is real and a relatively large issue at an early stage would have resolved this. Unfortunately in this case we didn't have the ability to influence the project during these early days.

It's very easy to get excited about the potential to automate certain tasks or rely on user-generated content when designing new products. This project highlighted the need to start with manual creation of the vore value prop in order to prove it was possible to create and highlight the most important parts of that process to automate. In this example, manually creating insights from real business data would have made the true insights Vonto was hoping to create much more obvious and provided a clearer path towards generalising these across businesses.